A Product of

ASX:PE1

Exposure to some of the world’s leading private companies in a single ASX trade.

- Global leader in high-performance specialty materials used across industrial, automotive, and energy applications.

- Expanding into advanced battery materials through its SiFAB product line.

- Positioned to benefit from global demand for lightweight, sustainable technologies.

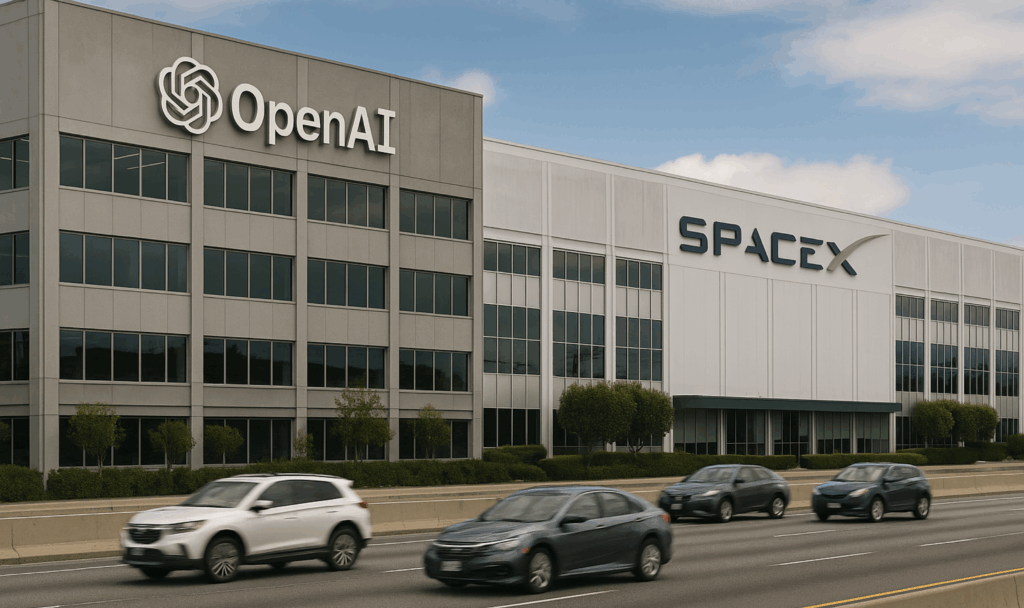

- Dominant player in commercial launches and satellite connectivity through Starlink.

- Reusable rocket technology drives efficiency and industry cost leadership.

- Exposure to long-term growth in the rapidly expanding global space economy.

- Pioneer in artificial intelligence and developer of ChatGPT and enterprise AI solutions.

- Backed by strategic partnerships with Microsoft and leading institutional investors.

- Positioned at the forefront of generative AI and long-term technology innovation.

- Iconic sportswear and lifestyle brand with 100+ years of heritage.

- Exclusive headwear partner to Major League Baseball and licensed across major global sports leagues.

- Growth driven by international expansion and direct-to-consumer channels.

- Digital freight platform improving transparency and efficiency in US logistics.

- Leverages data and automation to connect shippers with carriers in real time.

- Scaled growth supported by enterprise partnerships and industry consolidation.

- Leading software and payments platform serving faith-based and non-profit organisations.

- Supports 90,000+ clients with member management, giving, and engagement tools.

- Strong recurring revenue base supported by ongoing innovation and acquisitions.

- Major supplier of whey-based ingredients for sports nutrition and wellness markets.

- Vertically integrated US manufacturing and long-term customer relationships.

- Benefiting from structural growth in high-protein and clean-label nutrition.

- On-demand delivery platform operating across hundreds of US cities.

- Owns its fulfilment network, enabling rapid and reliable service.

- Positioned at the intersection of e-commerce, logistics, and consumer convenience.

- Portfolio includes leading bottled water names such as Poland Spring and Arrowhead.

- Broad distribution across retail and home-delivery channels.

- Resilient consumer staple supported by long-term health and hydration trends.

- Largest supplier of fresh and processed garlic in the United States.

- Stable demand and long-standing retailer relationships underpin performance.

- Investing in automation and capacity expansion to drive future growth.

- Leading aftermarket drivetrain and wheel components supplier for trucks and SUVs.

- Broad brand portfolio distributed across retail, e-commerce, and installer channels.

- Strong recurring demand supported by vehicle maintenance and customisation trends.

- India’s leading fintech platform targeting affluent, creditworthy users.

- Combines payments, rewards, and financial products in one integrated app.

- Exposure to India’s fast-growing digital payments and wealth management markets.

- Vertically integrated producer of premium refrigerated beverages and fresh foods.

- Strong position in plant-based and health-focused consumer categories.

- Supported by growing demand for natural and functional nutrition.

- US leader in overhead crane inspection, maintenance, and repair services.

- Recurring service contracts provide stable, predictable revenue.

- Growth driven by regional expansion and investment in automation.

- One of the largest veterinary care networks in the United States.

- Operates general and specialty clinics with strong recurring revenue visibility.

- Supported by secular growth in pet ownership and animal health spending.

- Core technology provider for US Medicaid and public health program administration.

- Serves two-thirds of Medicaid beneficiaries through mission-critical platforms.

- Expansion supported by data-driven analytics and long-term government contracts.

- Leading European and African mobility platform spanning ride-hailing, scooters, and delivery.

- Efficient pricing and operating model drive market-leading share across key regions.

- Expanding into adjacent services such as grocery and e-commerce delivery.

- One of the largest independent wealth management networks in the US.

- Serves over 10,000 advisers with technology, compliance, and operational support.

- Profitable platform benefiting from scale, acquisitions, and recurring advisory revenue.

- Specialty property and casualty insurer with strong underwriting expertise.

- Expanding through strategic acquisitions including Lancer Insurance.

- Exposure to diversified commercial and niche insurance markets with stable returns.

- Major US government contractor in intelligence, defence, and civil sectors.

- Formed through the combination of several heritage businesses including Perspecta.

- Benefiting from rising federal investment in cyber, space, and national security technology.

- Global logistics provider offering multimodal, asset-light transport solutions.

- Integrated services across freight forwarding, warehousing, and customs.

- Supported by global trade growth and structural expansion in e-commerce logistics.

- Global producer of specialty phosphate and non-phosphate ingredients.

- Core supplier to food, beverage, health, and industrial applications.

- Benefiting from rising demand for fortified and functional nutrition products.

ASX: PE1 DELIVERS

SIMPLICITY

A single ASX trade provides exposure to a well-diversified portfolio of global private equity investments.

ACCESS

Institutional management capability providing exposure over subscribed and difficult to access managers.

RETURNS

PE’s historical outperformance supplemented by a 4% target cash distribution yield.1

The only way to access  on the asx.

on the asx.

SpaceX is PE1’s largest underlying portfolio company exposure as of 30 November 2025, comprising 7.7% of the Trust’s private markets exposure.

PERFORMANCE

14.9%

ONE YEAR RETURN2

8.7%

PER ANNUM, SINCE INCEPTION2

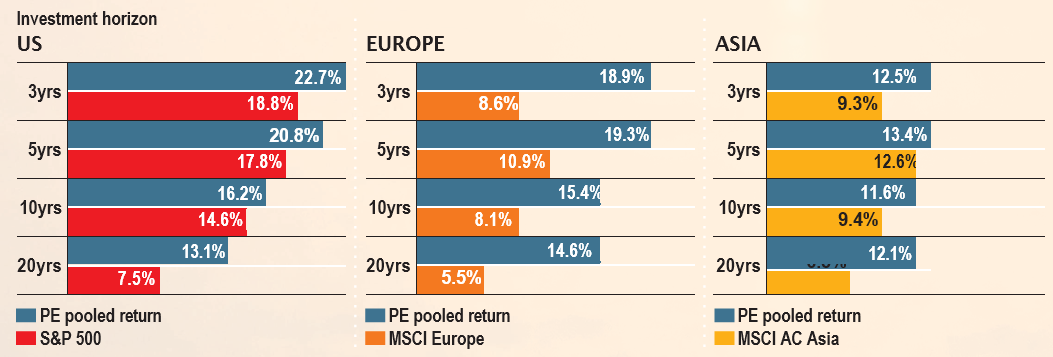

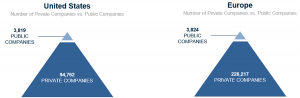

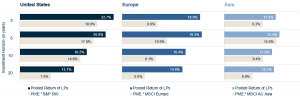

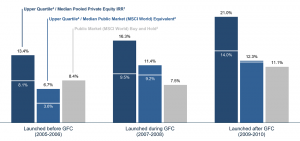

Private Equity has historically outperformed Listed Equity3

Across time

periods

Across

Regions

Through different economic conditions

With less

volatility

A WORLD OF PRIVATE COMPANIES.

ONE ASX TRADE.

PE1 is Australia’s only globally diversified private equity fund listed on the ASX, with exposure to over 550 private companies across multiple sectors and geographies (with some past and present examples below).

- Global leader in high-performance specialty materials used across industrial, automotive, and energy applications.

- Expanding into advanced battery materials through its SiFAB product line.

- Positioned to benefit from global demand for lightweight, sustainable technologies.

- Dominant player in commercial launches and satellite connectivity through Starlink.

- Reusable rocket technology drives efficiency and industry cost leadership.

- Exposure to long-term growth in the rapidly expanding global space economy.

- Pioneer in artificial intelligence and developer of ChatGPT and enterprise AI solutions.

- Backed by strategic partnerships with Microsoft and leading institutional investors.

- Positioned at the forefront of generative AI and long-term technology innovation.

- Iconic sportswear and lifestyle brand with 100+ years of heritage.

- Exclusive headwear partner to Major League Baseball and licensed across major global sports leagues.

- Growth driven by international expansion and direct-to-consumer channels.

- Digital freight platform improving transparency and efficiency in US logistics.

- Leverages data and automation to connect shippers with carriers in real time.

- Scaled growth supported by enterprise partnerships and industry consolidation.

- Leading software and payments platform serving faith-based and non-profit organisations.

- Supports 90,000+ clients with member management, giving, and engagement tools.

- Strong recurring revenue base supported by ongoing innovation and acquisitions.

- Major supplier of whey-based ingredients for sports nutrition and wellness markets.

- Vertically integrated US manufacturing and long-term customer relationships.

- Benefiting from structural growth in high-protein and clean-label nutrition.

- On-demand delivery platform operating across hundreds of US cities.

- Owns its fulfilment network, enabling rapid and reliable service.

- Positioned at the intersection of e-commerce, logistics, and consumer convenience.

- Portfolio includes leading bottled water names such as Poland Spring and Arrowhead.

- Broad distribution across retail and home-delivery channels.

- Resilient consumer staple supported by long-term health and hydration trends.

- Largest supplier of fresh and processed garlic in the United States.

- Stable demand and long-standing retailer relationships underpin performance.

- Investing in automation and capacity expansion to drive future growth.

- Leading aftermarket drivetrain and wheel components supplier for trucks and SUVs.

- Broad brand portfolio distributed across retail, e-commerce, and installer channels.

- Strong recurring demand supported by vehicle maintenance and customisation trends.

- India’s leading fintech platform targeting affluent, creditworthy users.

- Combines payments, rewards, and financial products in one integrated app.

- Exposure to India’s fast-growing digital payments and wealth management markets.

- Vertically integrated producer of premium refrigerated beverages and fresh foods.

- Strong position in plant-based and health-focused consumer categories.

- Supported by growing demand for natural and functional nutrition.

- US leader in overhead crane inspection, maintenance, and repair services.

- Recurring service contracts provide stable, predictable revenue.

- Growth driven by regional expansion and investment in automation.

- One of the largest veterinary care networks in the United States.

- Operates general and specialty clinics with strong recurring revenue visibility.

- Supported by secular growth in pet ownership and animal health spending.

- Core technology provider for US Medicaid and public health program administration.

- Serves two-thirds of Medicaid beneficiaries through mission-critical platforms.

- Expansion supported by data-driven analytics and long-term government contracts.

- Leading European and African mobility platform spanning ride-hailing, scooters, and delivery.

- Efficient pricing and operating model drive market-leading share across key regions.

- Expanding into adjacent services such as grocery and e-commerce delivery.

- One of the largest independent wealth management networks in the US.

- Serves over 10,000 advisers with technology, compliance, and operational support.

- Profitable platform benefiting from scale, acquisitions, and recurring advisory revenue.

- Specialty property and casualty insurer with strong underwriting expertise.

- Expanding through strategic acquisitions including Lancer Insurance.

- Exposure to diversified commercial and niche insurance markets with stable returns.

- Major US government contractor in intelligence, defence, and civil sectors.

- Formed through the combination of several heritage businesses including Perspecta.

- Benefiting from rising federal investment in cyber, space, and national security technology.

- Global logistics provider offering multimodal, asset-light transport solutions.

- Integrated services across freight forwarding, warehousing, and customs.

- Supported by global trade growth and structural expansion in e-commerce logistics.

- Global producer of specialty phosphate and non-phosphate ingredients.

- Core supplier to food, beverage, health, and industrial applications.

- Benefiting from rising demand for fortified and functional nutrition products.

Why Now

A Market at an Inflection Point

Public valuations are stretched, but private equity is finding healthier ground as deal and exit activity picks up, supported by a lower cost of capital.

Structural Growth That Endures

Long-term trends continue to power opportunity:

- Digital transformation across industries

- Healthcare innovation

- Resilient and sustainable business models

These themes are fueling the next wave of private market growth.

Diversification That Drives Stability

Performance now varies widely across strategies, vintages, and managers.

A balanced portfolio across buyouts, growth, secondaries, and co-investments helps:

- Reduce concentration risk

- Smooth returns over time

- Capture a broader set of value creation opportunities

How PE1 Benefits

PE1 provides access to leading private equity managers and a diversified mid-market portfolio designed for sustainable long-term returns.

With a mature underlying asset base generating increasing distributions and a permanent on-market buyback supporting the value of PE1 units, the trust aims to deliver both ongoing income and enhanced shareholder outcomes.

Download Your Investor Insights on Private Equity & PE1

HARNESSING GLOBAL EXPERTISE*

Brought to you by Pengana Capital Group, in partnership with Chicago-based GCM Grosvenor — one of the world’s largest and most established allocators to alternative investments.

Grosvenor Capital Management, L.P. (“GCM Grosvenor”) is one of the world’s longest-standing and most diversified independent alternative asset managers. Established in 1971, GCM Grosvenor manages over US$87 billion in assets across private equity, infrastructure, real estate, credit, and absolute return strategies, with a focus on delivering customised solutions for institutional investors globally.

25+

Years Experience in Private Markets

Proven performance across multiple market cycles.

US$31B+

PE Assets Under Management

Deployed across more than 1,300 global investments.

1,340+

PE Investments Across Strategies and Geographies**

A global portfolio built for diversification and access.

545

PE Manager Relationships**

Access to leading and hard-to-reach private equity sponsors.

Key Fund Metrics

UNIT

PRICE (ASX)

NAV

PER UNIT5

$1.675

31/12/2025

PERFORMANCE SINCE INCEPTION2

8.7% p.a.

TARGET DISTRIBUTION YIELD1

4%

INVESTING WITH INTENTION

1

Discovery & Research

Deep Market Intelligence

Proprietary research identifies emerging opportunities across global private markets.

2

Rigorous Due Diligence

Investment and Operational Details Scrutinised

In-depth evaluation of teams, strategies, and performance.

3

Portfolio Construction

Diversified by Design

Capital deployed across buyouts, growth, secondaries, and co-investments to balance risk and return.

4

Continuous Monitoring

Assessed from Multiple Angles

Active oversight and proprietary analytics ensure alignment and long-term value.

5

Outcome

Consistent Value Creation

A proven, data-informed process delivering durable results.

THE MIDDLE MARKET OPPORTUNITY

Where opportunity, diversification, and disciplined execution meet.

Multiple Paths to Value

Growth driven by operational improvement, digital transformation, strategic acquisitions, and international expansion - not just financial engineering.

Diversified Opportunity Set

Thousands of targets across sectors and geographies smooth outcomes and reduce reliance on single large deals.

Aligned Partnerships

Investing alongside specialist managers enables disciplined execution, alignment, and long-term results.

PE1 has a core focus on middle market private equity - Where opportunity and discipline can drive durable returns.

Lonsec Recommended Rating⁺

Independent Investment Research⁺⁺

Pengana Capital Group

GCM

Grosvenor

INVEST TODAY

UNITS IN PE1 ARE AVAILABLE ON THE ASX

As Wall Street buzzes with anticipation ahead of the historic float of Elon Musk’s SpaceX, Melbourne-based Pengana Capital is watching...

Investors are missing more of the growth story than ever before. Over the past two decades, the global equity landscape has quietly transformed...

There’s an old saying: Markets climb a wall of worry But with persistent geopolitical tensions, rising economic uncertainty, and the...

Data shows that global private equity (PE) is on the rebound, yet sentiment hasn’t caught up and good discounts are...

Get closer to the world’s leading private companies.

Investing is not without risk, you can view a summary of the risks associated with the trust here.

PUBLIC MARKETS ARE JUST THE TIP OF THE ICEBERG

PENGANA INVESTMENT MANAGEMENT LIMITED

ABN 69 063 081 612

AFSL 219462

Suite 1, Level 27,

Governor Phillip Tower,

1 Farrer Place,

Sydney, NSW, 2000

CONTACT:

1300 855 080 (within Australia)

+61 3 9415 4000 (outside Australia)

[email protected]

Pengana intends to target a cash distribution yield equal to 4% p.a. (prorated on a non-compounded basis) of the NAV (including the cash distribution amount payable) as at the end of the period that a distribution relates to. The targeted distribution is only a target and may not be achieved. Investors should read the Risks summary set out in Section 11 of the IPO PDS.

Past performance is not a reliable indicator of future performance, the value of investments can go up and down. The net return has been determined with reference to the increase in the Net Asset Value per Unit, as well as of the reinvestment of a Unit’s distribution back into the Trust pursuant to the Trust’s distribution reinvestment plan (“DRP”). The NAV per unit at inception (23 April 2019), when used in performance calculations, is based on the subscription price per unit which is equal to $1.25. Pengana has established a DRP in respect of distributions made by the Trust. Under the DRP, Unitholders may elect to have all or part of their distribution reinvested in additional Units.

Analysis period includes the 20 years ending 30 September 2024. Portfolio calculation assumes quarterly rebalancing of stock and bond allocations. Index returns assume reinvestment of coupons. “Global Equity Allocation” represented by MSCI World Index, “Global Bond Allocation” represented by Bloomberg Barclays Global Aggregate Bond Index, “Private Equity Allocation” represented by Burgiss private equity pooled time-weighted returns.

* Data as of September 30, 2025 unless otherwise noted.

**Data as of June 30 2025.Source: Prepared by GCM utilising certain information obtained from Burgiss based on published 3Q 2024 benchmark data as of 10 March 2025. Burgiss sources their data from MSCI, Bloomberg Barclays and private equity funds worldwide (the “Burgiss Manager Universe”). The Burgiss Manager Universe includes data from 8,250 global private funds. GCM uploads data into its system used to prepare the above graph one-time each quarter; however, the data service may continue to update its information thereafter. Therefore, information in GCM’s system may not always agree with the most current information available from the data service. Additional information is available upon request. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This graph is not approved or produced by MSCI. Burgiss, MSCI, and Bloomberg Barclays have not provided consent to the inclusion of statements utilising their data. Past performance is not necessarily a guide to future performance. No assurance can be given that any investment will achieve its objective or avoid losses.

The NAV is unaudited.

† Lonsec rating issued 10/2025 is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2022 Lonsec. All rights reserved.

†† The Independent Investment Research (IIR) rating is required to be read with the full research report that can be found on the issuer’s website (or upon request) together with the full disclaimer that is found on the front cover of the research note. IIR requires readers of their research note to obtain advice from their wealth manager before making any decisions with respect to the recommendation on this note. The note is not general advice just financial information without having regard to the financial circumstances of the reader.

None of Pengana Private Equity Trust (“PE1”), Pengana Investment Management Limited (ABN 69 063 081 612, AFSL 219 462) (“Responsible Entity”), Grosvenor Capital Management, L.P., nor any of their related entities guarantees the repayment of capital or any particular rate of return from PE1. Past performance is not a reliable indicator of future performance, the value of investments can go up and down. This document has been prepared by the Responsible Entity and does not take into account a reader’s investment objectives, particular needs or financial situation. It is general information only and should not be considered investment advice and should not be relied on as an investment recommendation.

Pengana Investment Management Limited (Pengana) (ABN 69 063 081 612, AFSL 219 462) is the issuer of units in the Pengana Private Equity Trust (ARSN 630 923 643) (the Trust). Before acting on any information contained within this report a person should consider the appropriateness of the information, having regard to their objectives, financial situation and needs. None of Pengana, Grosvenor Capital Management, L.P. (Grosvenor), or their related entities, directors, partners or officers guarantees the performance of, or the repayment of capital, or income invested in the Trust. An investment in the Trust is subject to investment risk including a possible delay in repayment and loss of income and principal invested.